Last updated on

These real estate rental statistics provide valuable insights into the rental market and help real estate professionals make informed decisions.

We cover a wide range of data points, including rental rates, vacancy rates, household income, and more. We begin by providing an overview of the key figures, highlighting some key metrics used to analyze the rental market.

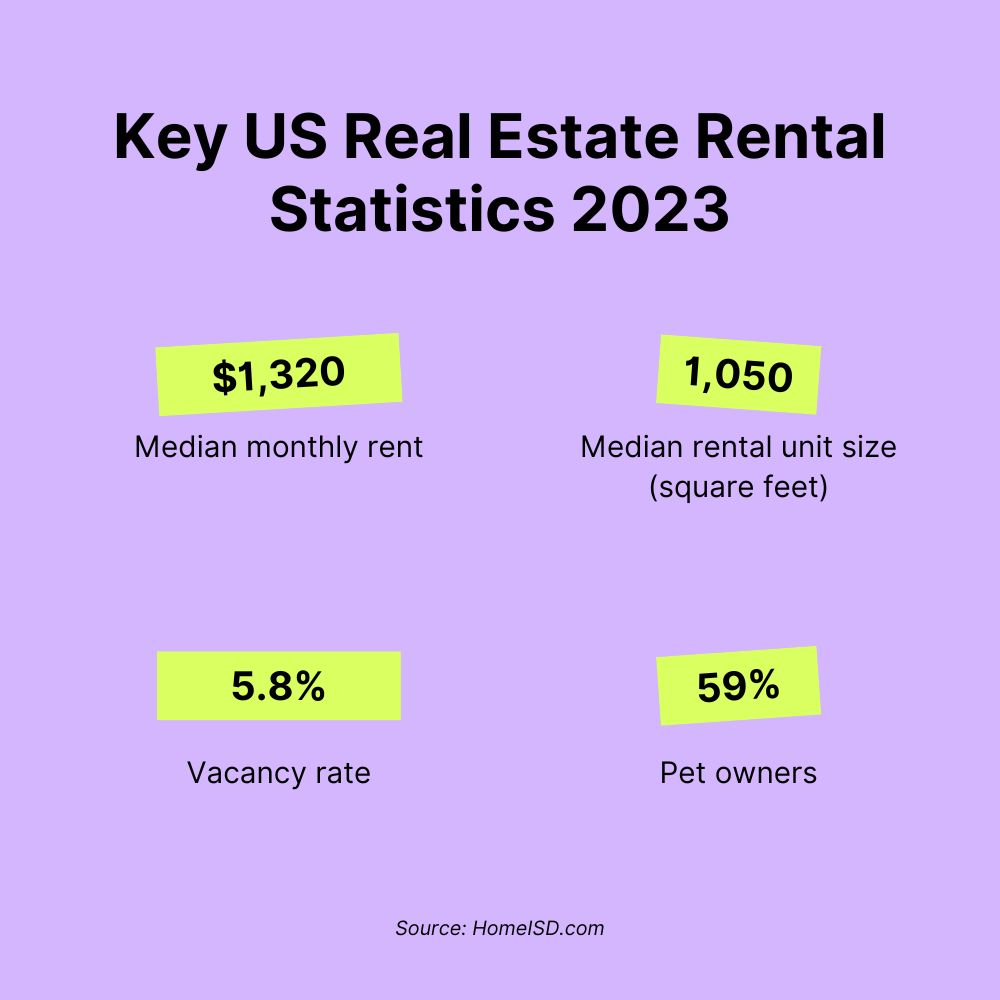

- Median monthly rent (US): $1,320

- Renter age: 48% are under 30

- Pet owners: 59%

- Highest rent: New York ($3,400+)

- Lowest rent: Oklahoma ($979)

- Top rental real estate: Apartment buildings (53%)

- Median rental unit size: 1,050 square feet

- Vacancy rate: 5.8%

State-Wise Median Rent

When it comes to real estate rental statistics, it’s important to take a look at state data to get a better understanding of the market. Below is a state-wise analysis of the rental market in the United States:

- California: California has one of the highest median rental prices in the country, with a median monthly rent of $2,500. However, the state also has some of the highest median household incomes, which may account for the higher rental prices. Los Angeles, San Francisco, and San Diego are some of the most expensive cities to rent in the state.

- Texas: Texas has a relatively affordable rental market, with a median monthly rent of $1,200. The state’s largest cities, Houston, Dallas, and Austin, have seen significant growth in the rental market in recent years, with rental prices increasing by around 3% per year.

- Florida: Florida is a popular destination for retirees and snowbirds, which has driven up rental prices in some areas. The median monthly rent in the state is $1,500, with cities like Miami and Orlando having higher rental prices than other areas.

- New York: New York has one of the highest median rental prices in the country, with a median monthly rent of $3,000. The state’s largest city, New York City, has some of the highest rental prices in the world, with the median monthly rent for a one-bedroom apartment exceeding $3,400.

- Illinois: Illinois has a relatively affordable rental market, with a median monthly rent of $1,200. Chicago, the state’s largest city, has seen a significant increase in rental prices in recent years, with the median monthly rent for a one-bedroom apartment exceeding $1,800.

- Colorado: Colorado has a growing rental market, with a median monthly rent of $1,500. Denver, the state’s largest city, has seen significant growth in the rental market in recent years, with rental prices increasing by around 5% per year.

- North Carolina: North Carolina has a relatively affordable rental market, with a median monthly rent of $1,100. The state’s largest city, Charlotte, has seen significant growth in the rental market in recent years, with rental prices increasing by around 4% per year.

Overall, the rental market in the United States varies greatly from state to state, with some areas having significantly higher rental prices than others. It’s important to consider state data when analyzing the rental market and making decisions about renting or investing in real estate.

Rental Statistics by U.S. Census Bureau

The U.S. Census Bureau provides a wealth of data on rental housing in the United States. This information is gathered through the Rental Housing Finance Survey (RHFS), the American Housing Survey (AHS), and the Housing Vacancy Survey (HVS). These surveys provide detailed statistics on rental units, housing costs, and vacancy rates.

According to the most recent RHFS data available from the U.S. Census Bureau, there were approximately 24.2 million rental units in the United States in 2021. The median gross rent for these units was $1,062 per month. Approximately 47.5% of renters spent 30% or more of their household income on rent and utilities, which is considered to be a cost burden.

The AHS provides additional information on the characteristics of rental units and their occupants. In 2021, the median year that rental units were built was 1979. The median size of rental units was 1,050 square feet. In terms of occupancy, approximately 37.7% of rental units were occupied by their owners, while the remaining 62.3% were rented.

The HVS provides data on the vacancy rates of rental units across the United States. In the second quarter of 2023, the national rental vacancy rate was 5.8%. This is slightly higher than the vacancy rate for owner-occupied homes, which was 2.3%.

Overall, the data provided by the U.S. Census Bureau on rental housing in the United States offers a comprehensive look at the state of the rental market. These statistics can be used by policymakers, researchers, and industry professionals to better understand the needs and challenges of renters across the country.

Housing and Homeownership Trends

The real estate industry has seen a lot of changes in recent years, and one of the most significant trends has been the shift in homeownership rates. According to a recent report by Pew Research Center, the homeownership rate in the United States has been steadily declining since the Great Recession. In 2022, the rate was 63.9%, down from a peak of 69.2% in 2004.

Despite the decline in homeownership, the demand for housing remains strong. The National Association of Realtors reports that existing-home sales increased by 1.7% in August 2023, marking the second consecutive month of growth. The rise in sales was driven by low mortgage rates and a shortage of available homes for sale.

However, the shortage of homes for sale has also contributed to rising home prices. The median existing-home price in the United States was $356,700 in August 2023, up 8.2% from the previous year, according to the National Association of Realtors. This increase in home prices has made it more difficult for first-time homebuyers to enter the market, which has led to an increase in demand for rental properties.

The rental market has also seen significant changes in recent years. According to a report by NerdWallet, more than 35% of households in the United States rent their homes. The report also notes that rent growth has finally slowed down after years of steady increases. In 2023, the average monthly apartment rent in the United States was $1,320, up 3% from the previous year, according to Statista.

Overall, the real estate market remains strong, with both the rental and residential real estate markets experiencing growth. However, the shortage of available homes for sale and rising home prices have made it more difficult for first-time homebuyers to enter the market. As a result, the demand for rental properties is likely to continue to grow in the coming years.

Rental Market Dynamics

The rental market is a dynamic environment that is constantly changing. Understanding the dynamics of the rental market is crucial for both landlords and tenants. This section will explore some of the key dynamics of the rental market.

Demand

One of the most important dynamics of the rental market is demand. Demand for rental properties is influenced by a variety of factors, including population growth, job growth, and affordability. In recent years, demand for rental properties has been strong due to a variety of factors, including an increase in the number of renters and a decline in the homeownership rate.

Sales

Sales of rental properties can also impact the rental market. When rental properties are sold, they may be converted to owner-occupied homes or sold to new landlords. This can impact the supply of rental properties in the market, which can in turn impact rental prices.

Rents

Rental prices are a key indicator of the health of the rental market. Rental prices are influenced by a variety of factors, including supply and demand, inflation, and year-over-year changes. In recent years, rental prices have been increasing in many markets due to strong demand and limited supply.

Asking Rent

Asking rent is the price that landlords ask for their rental properties. Asking rent can be influenced by a variety of factors, including the condition of the property, the location, and the amenities that are offered. In some markets, landlords may be able to ask for higher rents due to strong demand.

Rent Increases

Rent increases are a common occurrence in the rental market. Rent increases can be influenced by a variety of factors, including inflation, year-over-year changes, and changes in the supply and demand for rental properties. In some markets, rent increases may be limited by rent control regulations.

Gross Rents

Gross rents are the total amount of rent that is collected by landlords. Gross rents can be influenced by a variety of factors, including the number of rental properties that a landlord owns, the rental prices that are charged, and the vacancy rates for rental properties.

Vacancy Rates

Vacancy rates are a key indicator of the health of the rental market. High vacancy rates can indicate an oversupply of rental properties, while low vacancy rates can indicate strong demand for rental properties. Vacancy rates can be influenced by a variety of factors, including population growth, job growth, and the number of new rental properties that are being built.

Inflation

Inflation can impact the rental market in a variety of ways. Inflation can impact the cost of living, which can in turn impact the amount of rent that tenants are willing to pay. Inflation can also impact the cost of maintaining and repairing rental properties, which can impact the profitability of landlords.

Year-Over-Year

Year-over-year changes are a key indicator of the health of the rental market. Year-over-year changes can indicate whether the market is growing or contracting. Year-over-year changes can be influenced by a variety of factors, including changes in supply and demand, changes in the economy, and changes in government regulations.

Demographic Factors Influencing Rentals

When it comes to the rental market, several demographic factors play a crucial role in determining the demand and supply of rental properties. Here are some of the most significant demographic factors that influence rentals:

Millennials

Millennials, who are now the largest generation in the US, are a significant factor in the rental market. Many millennials are choosing to rent instead of buying homes due to financial constraints, job mobility, and a preference for urban living. As a result, the rental market has seen a surge in demand for apartments, condos, and other rental properties in urban areas.

Residents

The type of residents in a particular area can also influence the rental market. For example, areas with a high concentration of students are likely to have a higher demand for rental properties, such as apartments and shared housing. On the other hand, areas with a large number of families may have a higher demand for single-family homes and larger rental properties.

College

College towns are another significant factor in the rental market. These areas tend to have a high demand for rental properties due to the large number of students who need housing. As a result, landlords in college towns may charge higher rents, and rental properties may be leased quickly.

Urban

Urban areas tend to have a higher demand for rental properties due to their proximity to jobs, entertainment, and cultural attractions. Many renters prefer to live in urban areas due to the convenience and accessibility they offer. As a result, rental properties in urban areas may command higher rents and may be leased quickly.

Suburban

Suburban areas also play a significant role in the rental market. Many families prefer to live in suburban areas due to the larger homes, access to good schools, and lower crime rates. As a result, rental properties in suburban areas may command higher rents, and landlords may have a steady stream of tenants.

In conclusion, several demographic factors influence the rental market, including millennials, residents, college towns, urban areas, and suburban areas. Landlords and property managers should consider these factors when setting rental prices, marketing rental properties, and making other strategic decisions.

Income and Rent Correlation

The relationship between income and rent is an important factor to consider when analyzing the rental market. Generally, the higher the income, the more money a person can afford to spend on rent. However, this is not always the case, as other factors such as location, family size, and personal preferences can also affect the amount a person is willing to spend on rent.

According to a report by iPropertyManagement, 41.61% of renting households in the US have an annual income below $35,000. In contrast, 16.50% have an income of $75,000 or more. This suggests that a significant portion of renters may struggle to afford high rents, particularly in areas with high housing costs.

The median gross rent in the US was $1,062 in 2020, according to the US Census Bureau. However, this figure varies widely by location, with some cities having median rents that are much higher. For example, the median rent in San Francisco was $1,905 in 2020, while the median rent in Detroit was $772.

Overall, the income and rent correlation is an important factor to consider when analyzing the rental market. While higher incomes generally allow for higher rents, other factors such as location and personal preferences can also play a significant role in determining how much a person is willing to spend on rent.

Role of Websites and Publications

Real estate rental websites and publications play a crucial role in providing valuable information to potential renters and landlords. These resources offer a wealth of data and insights on the rental market, including rental prices, vacancy rates, and trends.

Websites like Zillow provide up-to-date rental listings, including photos and detailed descriptions of properties. They also offer tools to help renters and landlords calculate rental prices and track market trends. Zillow’s rental index, for example, provides a snapshot of rental prices across the country, allowing renters and landlords to compare prices in different areas.

News outlets and publications also play a vital role in providing information on the rental market. They often report on trends and changes in the market, including changes in rental prices and vacancy rates. This information can be valuable for renters and landlords looking to make informed decisions about renting or leasing properties.

Publications like the National Association of Realtors (NAR) offer research reports and market analysis on the rental market. The NAR’s 2018 Real Estate in a Digital Age report, for example, provides insights into how technology is changing the real estate industry and how renters and landlords are using technology to find and lease properties.

Overall, websites and publications provide valuable information and insights on the rental market. Renters and landlords should take advantage of these resources to make informed decisions about renting and leasing properties.

Impact of Employment on Rentals

Employment is a crucial factor that impacts the rental market in the United States. As the employment rate increases, the demand for rental properties also increases. In contrast, when the employment rate decreases, the demand for rental properties decreases as well.

According to a forecast by Statista, the number of workers in the real estate, rental, and leasing industry in the United States is projected to increase from 2.1 million in 2019 to 2.3 million in 2026. This increase in employment can be attributed to the growing demand for rental properties.

Furthermore, employment plays a significant role in determining the rental rates. Renters who are employed and have a stable income are more likely to pay higher rents than those who are unemployed or have an unstable income. According to a report by the Joint Center for Housing Studies, renters earning less than $25,000 were more likely to be behind on rent payments compared to those earning more than $75,000.

Employment also affects the rental market in terms of location. Renters tend to move to areas where there are more employment opportunities. For instance, cities with a high concentration of job opportunities, such as New York City and San Francisco, have higher rental rates compared to areas with fewer job opportunities.

In conclusion, the impact of employment on the rental market cannot be overstated. As employment rates continue to fluctuate, so will the demand for rental properties. Therefore, it is crucial for landlords and property managers to keep a close eye on the employment rates in their area to make informed decisions about rental rates and property investments.

Property Management and Leasing

The property management industry in the United States generates $99.449 billion in annual revenue, according to iPropertyManagement. The industry has been growing at an average rate of 5.0% annually since 2012, but it declined by 1.91% in 2022. Property management wages represent 43.0% of industry revenue.

Leasing is a crucial aspect of the property management industry. Leases are legally binding agreements between landlords and tenants that outline the terms and conditions of renting a property. The lease agreement typically includes information about the rental amount, security deposit, length of the lease, and any other pertinent details.

Landlords are responsible for managing their properties and ensuring that they are in good condition for tenants. They must also comply with state and federal laws regarding fair housing, safety, and maintenance. Property management companies can assist landlords in these tasks, providing services such as rent collection, maintenance, and tenant screening.

Real estate lessors, or landlords, own and lease out real estate properties. They may own residential properties, such as apartments and single-family homes, or commercial properties, such as office buildings and retail spaces. Real estate lessors must maintain their properties and ensure that they are in good condition for tenants. They must also comply with state and federal laws regarding fair housing, safety, and maintenance.

In summary, property management and leasing are crucial components of the real estate industry. Landlords and property management companies must ensure that their properties are in good condition and comply with state and federal laws. Leases are legally binding agreements that outline the terms and conditions of renting a property. Real estate lessors own and lease out real estate properties, and must maintain their properties and comply with state and federal laws.

Insights from Bureau of Labor Statistics

According to the Bureau of Labor Statistics, the Real Estate and Rental and Leasing industry in the United States employed approximately 2.2 million people in 2020. The industry is projected to grow by 2.7% annually between 2020 and 2030, which is slightly lower than the projected growth rate for all industries combined.

The Bureau of Labor Statistics also reports that the median hourly wage for workers in the Real Estate and Rental and Leasing industry was $21.03 in 2020, which is higher than the median hourly wage for all industries combined. Furthermore, the industry has a relatively low unemployment rate of 2.5%, which is lower than the unemployment rate for all industries combined.

Real estate brokers and sales agents are a significant part of the industry. The Bureau of Labor Statistics reports that there were approximately 438,000 real estate brokers and sales agents employed in the United States in 2020. The occupation is projected to grow by 2.8% annually between 2020 and 2030, which is slightly lower than the projected growth rate for all occupations combined.

The median hourly wage for real estate brokers and sales agents was $24.14 in 2020, which is higher than the median hourly wage for all occupations combined. However, the occupation has a relatively high turnover rate, with many workers leaving the industry after a few years.

Overall, the Bureau of Labor Statistics data suggests that the Real Estate and Rental and Leasing industry is a growing and relatively stable industry in the United States. The industry offers higher than average wages and low unemployment rates, but also has a high rate of turnover for some occupations.

References

- https://ipropertymanagement.com/research/property-management-industry-statistics

- https://www.bls.gov/iag/tgs/iag53.htm

- NerdWallet

- Statista

- Census.gov

- RentCafe

- FitSmallBusiness

- Zillow

Recap